Common questions that may come to an investor's mind when thinking about real estate investment in Dubai...

Investing in real estate in Dubai can be a lucrative venture, given the city’s dynamic market and strategic location. Here’s a step-by-step guide to help you choose and buy a house for investment in Dubai:

Define Your Investment Goals:

Determine your investment objectives. Are you looking for long-term capital appreciation, rental income, or a combination of both?

Research the Dubai Real Estate Market:

Understand the current real estate market trends, demand-supply dynamics, and potential for future growth. Consider factors such as infrastructure development, economic stability, and government policies.

Set a Budget:

Establish a realistic budget for your investment. Consider not just the property cost but also additional expenses like registration fees, agent commissions, and maintenance costs.

Choose the Right Location:

Dubai offers a variety of neighborhoods with different vibes and amenities. Research and select a location based on your investment goals, such as proximity to business districts, lifestyle preferences, and potential for rental yield.

Consult with Real Estate Experts:

Engage with local real estate agents and consultants who have in-depth knowledge of the Dubai market. They can provide valuable insights, guide you through the process, and help you find suitable properties.

Verify Property Developers:

Ensure that the property developer has a good reputation and a track record of delivering quality projects on time. Research their past developments and customer reviews.

Consider Off-Plan Properties:

Off-plan properties can offer attractive prices and payment plans. However, conduct due diligence on the developer’s credibility and track record.

Legal Considerations:

Understand the legal aspects of buying property in Dubai. Non-residents usually need to involve a registered real estate agent and obtain necessary approvals from the Dubai Land Department.

Financial Planning:

Explore financing options if needed. Some banks in Dubai offer mortgages to non-residents, but terms and conditions may vary.

Visit the Property:

If possible, visit the property and the surrounding area to get a firsthand feel of the location and amenities.

Negotiate the Price:

Don’t hesitate to negotiate the price. Developers may offer incentives or discounts, especially if you’re buying directly from them.

Finalize the Purchase:

Once the terms are agreed upon, complete the necessary paperwork, pay the deposit, and proceed with the legal formalities. This typically involves signing a Memorandum of Understanding (MOU) and paying a reservation fee.

Transfer of Ownership:

Complete the transfer of ownership at the Dubai Land Department. Pay the necessary fees and taxes to complete the transaction.

Consider Property Management:

If you’re planning to rent out the property, consider hiring a reputable property management company to handle tenant relations, maintenance, and other aspects.

Remember to stay informed about market trends and legal requirements throughout the process. Working with experienced professionals can significantly ease the process of buying a house for investment in Dubai, with our regards “Palmyra Properties”…

The choice between investing in an off-plan property or a secondary used property in Dubai depends on various factors and your investment goals. Both options have their pros and cons, so let’s explore them:

Off-Plan Property:

Pros:

Potential for Price Appreciation: Off-plan properties are often sold at a lower price than completed properties. As the development progresses, the value of the property may increase, offering potential capital appreciation by the time of completion.

Flexible Payment Plans: Developers typically offer attractive and flexible payment plans for off-plan properties, allowing you to spread payments over the construction period.

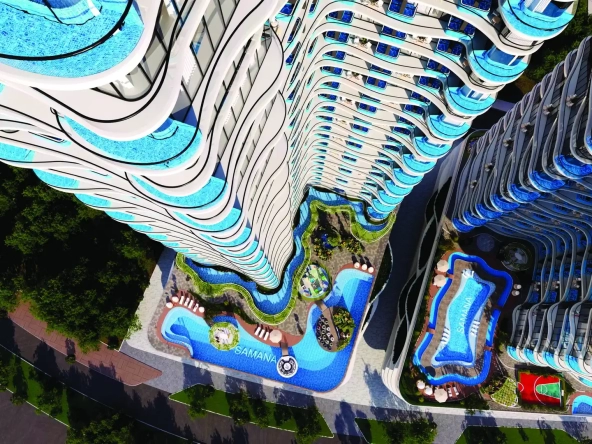

Modern Amenities: New developments often come with modern amenities and the latest technology, making them attractive to potential tenants or buyers.

Cons:

Delays and Risks: Construction delays and unforeseen challenges can occur, leading to delayed delivery of the property. There is also a risk that the developer may face financial issues.

Uncertainty in the Market: The real estate market can be unpredictable, and economic conditions may change during the construction period, affecting property values.

Secondary Used Property:

Pros:

Immediate Availability: You can move in or rent out a used property immediately after the purchase, providing a quicker return on investment.

Known Property Condition: Unlike off-plan properties, the condition and quality of a used property are known upfront. You can inspect the property before making a decision.

Stable Rental Income: If you plan to generate rental income, a used property can provide a stable income stream from day one.

Cons:

Potentially Higher Initial Cost: Used properties may have a higher initial purchase price compared to off-plan properties.

Limited Modern Amenities: Older properties may lack some of the modern amenities and features found in new developments.

Considerations:

Investment Goals: If you are looking for potential price appreciation and are willing to wait for the property to be completed, off-plan might be suitable. If you seek immediate returns, a secondary used property may be more appropriate.

Risk Tolerance:

Off-plan properties come with construction and market-related risks. Assess your risk tolerance and investment horizon before choosing.

Market Conditions:

Consider the current market conditions. In a market with strong demand for new developments, off-plan properties may be more attractive.

Developer Reputation: If opting for off-plan, thoroughly research the developer’s reputation, track record, and financial stability.

Ultimately, the decision should align with your financial goals, risk tolerance, and investment strategy. Diversifying your portfolio with a mix of off-plan and secondary properties could also be a strategy to balance potential risks and rewards. Consulting with local real estate experts and financial advisors can provide valuable insights tailored to your specific situation.

In the context of off-plan real estate deals, post-handover installments refer to a payment plan structure where the buyer makes payments to the developer in installments, not only during the construction phase but also after the property has been handed over or completed.

Here’s a breakdown of the key components:

Off-Plan Purchase:

- When you buy an off-plan property, you are essentially purchasing a property that is not yet built. Developers often offer attractive prices and flexible payment plans during the construction phase to attract buyers.

Handover:

- The handover is the point at which the construction of the property is completed, and it is ready for occupancy. At this stage, the developer formally hands over the property to the buyer.

Post-Handover Installments:

Post-handover installments are the payments that the buyer agrees to make to the developer after the property has been handed over. These payments are typically structured over a period of time, and the specific terms are outlined in the sales agreement.

The advantage of post-handover installments is that they allow buyers to spread the cost of the property over an extended period, often beyond the completion date. This can be beneficial for buyers who may not have the full purchase amount available at the time of handover.

The terms of post-handover installments, including the duration and frequency of payments, are negotiated between the buyer and the developer and are usually outlined in the sales contract.

Flexibility and Financing:

Post-handover installments provide flexibility to buyers, allowing them to manage their finances more effectively. It can also be a form of financing provided by the developer, offering an alternative to traditional bank mortgages.

Developers may structure post-handover payments based on milestones, such as annual payments or quarterly payments, depending on the agreement.

It’s important for buyers to carefully review the terms and conditions of post-handover installments, including any associated fees or interest rates. Additionally, buyers should consider the reputation and track record of the developer to ensure they can fulfill their commitments.

Failing to pay installments to the developer in Dubai can have serious consequences, both legally and financially.

Here are some potential risks:

– Contractual Violation:

When you purchase a property off-plan, you enter into a legally binding sales contract with the developer. Failing to make agreed-upon payments constitutes a breach of contract.

– Penalties and Fees:

The sales contract typically outlines penalties for late payments. These penalties can include additional fees, interest charges, and other financial consequences.

– Cancellation of Contract:

If you consistently fail to meet payment obligations, the developer may have the right to cancel the contract. This can result in the loss of any amounts already paid and the potential forfeiture of the property.

– Forfeiture of Payments:

Developers often structure payment plans with a series of post-handover installments. Failure to make these payments may result in the forfeiture of any amounts paid to date, including the initial deposit.

– Legal Action:

Developers may pursue legal action to enforce the terms of the contract and recover outstanding payments. This can lead to legal proceedings and additional costs.

– Blacklisting:

In extreme cases, non-payment may lead to being blacklisted by developers or real estate agencies. This could affect your ability to engage in future real estate transactions in Dubai.

Relationship with the Dubai Land Department:

– Registration of Defaults:

The Dubai Land Department plays a regulatory role in real estate transactions. Developers may report defaults to the Land Department, which could impact your standing as a buyer.

– Intervention by Land Department:

The Land Department may intervene in cases of disputes between developers and buyers. They may mediate or take action based on the specifics of the situation.

– Potential Legal Consequences:

If a case escalates, legal matters may involve the Dubai Land Department, and they may have a role in resolving disputes.

Mitigating Risks:

– Communication:

If you encounter financial difficulties, communicate with the developer early. Some developers may be willing to negotiate alternative payment plans if they are informed in advance.

– Legal Advice:

Seek legal advice if you are facing difficulties meeting payment obligations. A legal professional can provide guidance on potential options and help protect your interests.

– Understanding the Contract:

Before entering into an off-plan purchase, thoroughly understand the terms of the contract, including payment obligations, penalties, and consequences for default.

It’s crucial to approach property purchases with careful consideration, ensuring that you are financially capable of meeting the agreed-upon obligations. If facing challenges, proactive communication and seeking professional advice are key steps to potentially mitigate risks and find solutions.

When buying a property in Dubai, there are various secondary expenses and government fees that you should be aware of in addition to the property’s purchase price. These fees can include transaction costs, administrative fees, and charges associated with property registration. Here are some common secondary expenses and government fees in Dubai:

Transfer Fee:

A transfer fee is payable to the Dubai Land Department upon the transfer of ownership. This fee is typically a percentage of the property’s purchase price around 4%.

Mortgage Registration Fee:

If you are financing your property purchase through a mortgage, there may be a mortgage registration fee payable to the Dubai Land Department. This fee is associated with registering the mortgage on the property.

Real Estate Agent’s Commission:

If you engage the services of a real estate agent to facilitate the property transaction, a commission fee is typically payable. The commission is usually a percentage of the property’s purchase price and is negotiated between the buyer and the agent.

Conveyancing Fee:

Legal fees, also known as conveyancing fees, may be incurred for the services of a legal professional who assists in the property transfer process. These fees can vary depending on the complexity of the transaction and the legal services provided.

NOC (No Objection Certificate) Fee:

If you are buying a property in a community with a homeowners’ association or master developer, you may need to obtain a No Objection Certificate (NOC) to transfer ownership. There may be associated fees for obtaining the NOC.

Oqood Fee:

The Oqood fee is associated with the registration of the initial sale contract for off-plan properties. It is payable to the Dubai Land Department.

Service Charges (Pro-Rata):

If you are buying a property within a community governed by Developer or owners’ association, you may be required to pay a pro-rata share of the service charges. This covers maintenance and services provided within the community.

Home Insurance:

While not a government fee, it’s common for property buyers to obtain home insurance to protect their investment. The cost of home insurance varies based on the coverage and the insurance provider.

Valuation Fee:

Some banks may require a property valuation before approving a mortgage. This valuation fee is typically paid by the buyer and is part of the mortgage application process.

Admin Fees:

There may be administrative fees associated with various processes during the property transaction, such as document processing and other administrative tasks.

It’s important to carefully review the terms of the sale, consult with legal professionals, and factor in these additional expenses when budgeting for a property purchase in Dubai. Additionally, fees and regulations may change, so it’s advisable to check the latest information with relevant authorities or professionals.